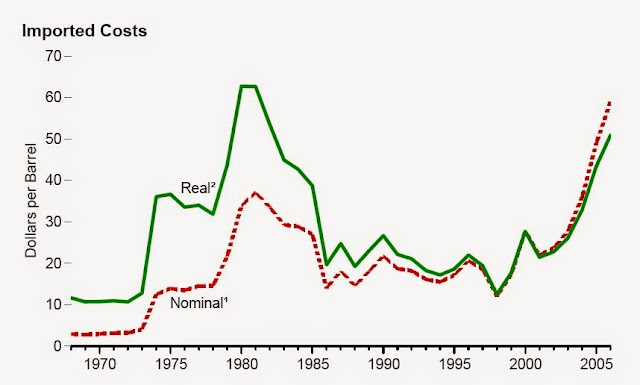

The price data graphed above are in nominal terms, meaning they are in "dollars-of-the-day" and have not been adjusted for inflation.

1.OPEC begins to assert power; raises tax rate & posted prices 2.OPEC begins nationalization process; raises prices in response to falling US dollar.

3.Negotiations for gradual transfer of ownership of western assets in OPEC countries

4.Oil embargo begins (October 19-20, 1973)

5.OPEC freezes posted prices; US begins mandatory oil allocation

6.Oil embargo ends (March 18, 1974)

7.Saudis increase tax rates and royalties

8.US crude oil entitlements program begins

9.OPEC announces 15% revenue increase effective October 1, 1975

10.Official Saudi Light price held constant for 1976

11.Iranian oil production hits a 27-year low

12.OPEC decides on 14.5% price increase for 1979

13.Iranian revolution; Shah deposed

14.OPEC raises prices 14.5% on April 1, 1979

15.US phased price decontrol begins

16.OPEC raises prices 15%

17.Iran takes hostages; President Carter halts imports from Iran; Iran cancels US contracts; Non-OPEC output hits 17.0 million b/d

18.Saudis raise marker crude price from 19$/bbl to 26$/bbl

19.US Windfall Profits Tax enacted

20.Kuwait, Iran, and Libya production cuts drop OPEC oil production to 27 million b/d

21.Saudi Light raised to $28/bbl

22.Saudi Light raised to $34/bbl

23.First major fighting in Iran–Iraq War

24.President Reagan abolishes remaining price and allocation controls

25.Spot prices dominate official OPEC prices

26.US boycotts Libyan crude; OPEC plans 18 million b/d output

27.Syria cuts off Iraqi pipeline

28.Libya initiates discounts; Non-OPEC output reaches 20 million b/d; OPEC output drops to 15 million b/d

29.OPEC cuts prices by $5/bbl and agrees to 17.5 million b/d output – January 1983

30.Norway, United Kingdom, and Nigeria cut prices

31.OPEC accord cuts Saudi Light price to $28/bbl

32.OPEC output falls to 13.7 million b/d

33.Saudis link to spot price and begin to raise output – June 1985

34.OPEC output reaches 18 million b/d

35.Wide use of netback pricing

36.Wide use of fixed prices

37.Wide use of formula pricing

38.OPEC/Non-OPEC meeting failure

39.OPEC production accord; Fulmar/Brent production outages in the North Sea

40.Exxon's Valdez tanker spills 11 million gallons of crude oil

41.OPEC raises production ceiling to 19.5 million b/d – June 1989

42.Iraq invades Kuwait

43.Operation Desert Storm begins; 17.3 million barrels of SPR crude oil sales is awarded

44.Persian Gulf war ends

45.Dissolution of Soviet Union; Last Kuwaiti oil fire is extinguished on November 6, 1991

46.UN sanctions threatened against Libya

47.Saudi Arabia agrees to support OPEC price increase

48.OPEC production reaches 25.3 million b/d, the highest in over a decade

49.Kuwait boosts production by 560,000 b/d in defiance of OPEC quota

50.Nigerian oil workers' strike

51.Extremely cold weather in the US and Europe

52.U.S. launches cruise missile attacks into southern Iraq following an Iraqi-supported invasion of Kurdish safe haven areas in northern Iraq.

53.Iraq begins exporting oil under United Nations Security Council Resolution 986.

54.Prices rise as Iraq's refusal to allow United Nations weapons inspectors into "sensitive" sites raises tensions in the oil-rich Middle East.

55.OPEC raises its production ceiling by 2.5 million barrels per day to 27.5 million barrels per day. This is the first increase in 4 years.

56.World oil supply increases by 2.25 million barrels per day in 1997, the largest annual increase since 1988.

57.Oil prices continue to plummet as increased production from Iraq coincides with no growth in Asian oil demand due to the Asian economic crisis and increases in world oil inventories following two unusually warm winters.

58.OPEC pledges additional production cuts for the third time since March 1998. Total pledged cuts amount to about 4.3 million barrels per day.

59.Oil prices triple between January 1999 and September 2000 due to strong world oil demand, OPEC oil production cutbacks, and other factors, including weather and low oil stock levels.

60.President Clinton authorizes the release of 30 million barrels of oil from the Strategic Petroleum Reserve (SPR) over 30 days to bolster oil supplies, particularly heating oil in the Northeast.

61.Oil prices fall due to weak world demand (largely as a result of economic recession in the United States) and OPEC overproduction.

62.Oil prices decline sharply following the September 11, 2001 terrorist attacks on the United States, largely on increased fears of a sharper worldwide economic downturn (and therefore sharply lower oil demand). Prices then increase on oil production cuts by OPEC and non-OPEC at the beginning of 2002, plus unrest in the Middle East and the possibility of renewed conflict with Iraq.

63.OPEC oil production cuts, unrest in Venezuela, and rising tension in the Middle East contribute to a significant increase in oil prices between January and June.

64.A general strike in Venezuela, concern over a possible military conflict in Iraq, and cold winter weather all contribute to a sharp decline in U.S. oil inventories and cause oil prices to escalate further at the end of the year.

65.Continued unrest in Venezuela and oil traders' anticipation of imminent military action in Iraq causes prices to rise in January and February, 2003.

66.Military action commences in Iraq on March 19, 2003. Iraqi oil fields are not destroyed as had been feared. Prices fall.

67.OPEC delegates agree to lower the cartel’s output ceiling by 1 million barrels per day, to 23.5 million barrels per day, effective April 2004.

68.OPEC agrees to raise its crude oil production target by 500,000 barrels (2% of current OPEC production) by August 1—in an effort to moderate high crude oil prices.

69.Hurricane Ivan causes lasting damage to the energy infrastructure in the Gulf of Mexico and interrupts oil and natural gas supplies to the United States. U.S. Secretary of Energy Spencer Abraham agrees to release 1.7 million barrels of oil in the form of a loan from the Strategic Petroleum Reserve.

70.Continuing oil supply disruptions in Iraq and Nigeria, as well as strong energy demand, raise prices during the first and second quarters of 2005.

71.Hurricanes Cindy, Dennis, Katrina, and Rita disrupt oil supply in the Gulf of Mexico.

72.In response to the hurricanes, the Department of Energy provides emergency loans of 9.8 million barrels and sold 11 million barrels of oil from the SPR.

73.Militant attacks in Nigeria shut in more than 600,000 barrels per day of oil production beginning in February 2006.

74.OPEC members agree to cut the organization’s crude oil output by 1.2 million barrels per day effective November 1, 2006. In December, the group agrees to cut output by a further 500,000 barrels per day effective February 2007.

Original concept for the chart was by the Analysis Division in the Office of Management Operations; Strategic Petroleum Reserve.

Modified and updated by the Office of Energy Markets and End Use in the Energy Information Administration.

No comments:

Post a Comment